THIS SURVEY EXPLORES CANADIANS’ AND AMERICANS’ MENTAL HEALTH, GREATEST SOURCE OF STRESS AND PERSONAL FINANCES

Inflation and rising prices have been impacting Canadians and Americans for months. Our latest North American Tracker provides a window into their current mental health (and a look at their mental health during the pandemic), their greatest source of stress and how inflation has impacted their finances.

Download the report for the full results.

This survey is conducted in collaboration with the Association for Canadian Studies (ACS) and published in the Canadian Press. This series of surveys is available on Leger’s website.

Would you like to be the first to receive these results? Subscribe to our newsletter now.

MENTAL HEALTH AND GREATEST SOURCE OF STRESS

- 50% of Canadians and 51% of Americans say their mental health is currently excellent or very good, representing an improvement in mental health compared to during the pandemic.*

- 36% of Canadians and 26% of Americans say their mental health worsened during the COVID-19 pandemic. Respectively, 55% and 58% say it stayed about the same.

- Canadians and Americans indicate that their current greatest source of stress is their personal finances (22% of Canadians, 18% of Americans) or inflation (16% of Canadians, 18% of Americans).

- 13% of Canadians and 14% of Americans are currently seeing a mental health professional.

*When surveyed by Leger in early February 2022, 32% of Canadians and 46% of Americans said they would rate their mental health excellent or very good since the beginning of the COVID-19 crisis.

PERSONAL FINANCES

- An equal portion of Canadians and Americans (41% each) say they are currently living paycheque to paycheque.

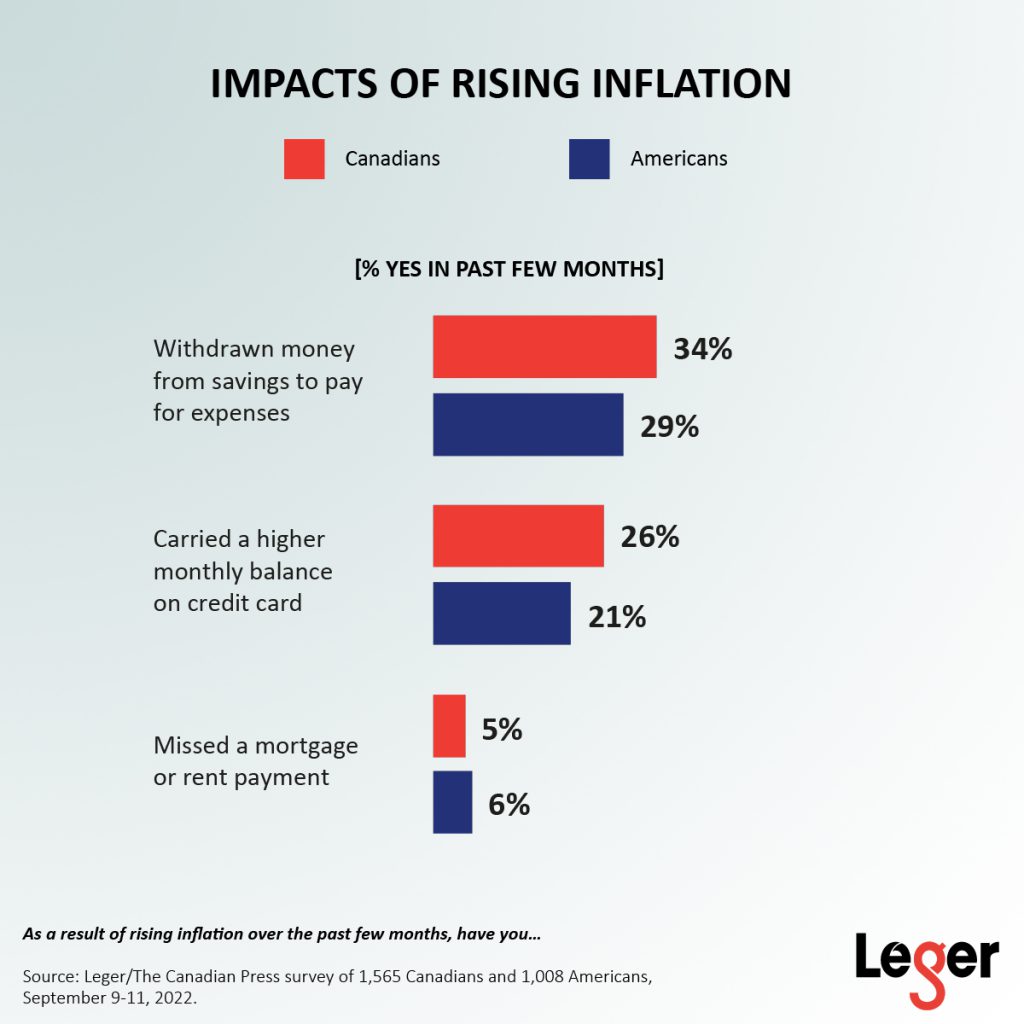

- As a result of rising inflation over the past few months:

- 34% of Canadians and 29% of Americans have withdrawn money from their savings to pay for expenses

- 26% of Canadians and 21% of Americans have carried a higher monthly balance on their credit card

- 5% of Canadians and 6% of Americans have missed a mortgage or rent payment

METHODOLOGY

This web survey was conducted from September 9 to 11, 2022, with 1,565 Canadians and 1,008 Americans, 18 years of age or older, randomly recruited from LEO’s online panel.

A margin of error cannot be associated with a non-probability sample in a panel survey. For comparison, a probability sample of 1,565 respondents would have a margin of error of ±2.51%, 19 times out of 20, while a probability sample of 1,008 respondents would have a margin of error of ±3.09%, 19 times out of 20.

THIS REPORT CONTAINS THE RESULTS FOR THE FOLLOWING QUESTIONS AND MORE!

- How would you rate your mental health currently?

- Which of the following is currently your greatest source of stress?

- Are you currently living paycheck to paycheck?

- As a result of rising inflation over the past few months, have you…