Are U.S. consumers optimistic or pessimistic about the future? Do they think the U.S. economy will improve or decline over the next 6 months? And how are concerns about the U.S. financial condition impacting their mental health? This final edition of Leger’s North American Tracker has the answers.

Are U.S. consumers optimistic or pessimistic about the future? Do they think the U.S. economy will improve or decline over the next 6 months? And how are concerns about the U.S. financial condition impacting their mental health? This final edition of Leger’s North American Tracker has the answers.

Sentiment is a primary driver when it comes to U.S. consumers’ behavior. Leger’s North American Tracker provides a pulse check on U.S. consumers’ perspectives on their lives, health, finances, and current events. As May is World Mental Health month, we focused on exploring consumers’ perspectives on the U.S. economy and how the economic situation is impacting their mental health.

What do this month’s findings reveal? From a research perspective, Ervin Murga, Research Director, noted,

“While American consumers are fairly optimistic about their lives and their health (physical and mental), financial problems continue to be a top priority for consumers. For the past few weeks, we’ve been hearing stories about banks failing and shutting down. So far, Silicon Valley Bank, First Republic Bank, and Signature Bank have been affected by the banking crisis, but how is this affecting consumers? We look at that data and how consumers feel about their lives, and more importantly, their savings and investments.”

About the Study

Leger’s North American Tracker is a monthly quantitative survey of 1,000+ U.S. (and Canadian) consumers aged 18 or over. Our team of market researchers evaluates and analyzes the data from the North American Tracker to reveal the most current consumer sentiments and behaviors.

Consumer Sentiment: Optimism Persists

Consumers continue to be optimistic about their lives overall, primarily driven by positive sentiments about their health and less so by their finances. With the World Economic forum recently reporting that “the U.S. economy could get worse before it gets better,” relatively lower levels of financial optimism may continue.

- 63% of American consumers are optimistic about their current life overall.

- Current mental health optimism is high (67%) as is physical health optimism (63%).

- On the other hand, financial optimism is lower (52%).

- Unsurprisingly, finance-related items top the list of U.S. consumers’ 3 biggest concerns: inflation, the U.S. economy, and rising gas prices (71%, 65%, and 33%, respectively).

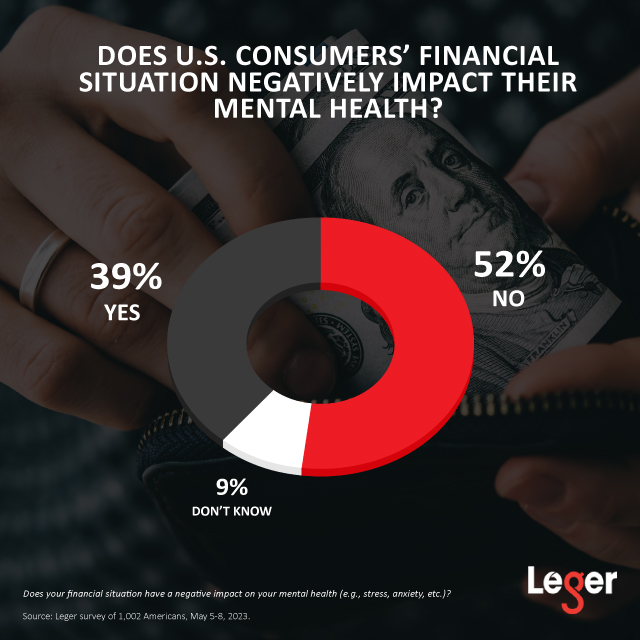

The U.S. Economy: Impacting Mental Health to Some Extent

This month, we explored the relationship between U.S. consumers’ financial situations and their mental health. Though many consumers are feeling stress related to the U.S. economy, for now, it is not having a large impact on their well-being.

- Three out of five consumers (61%) describe the economic condition of the United States as poor or very poor.

- The vast majority of Americans feel the economy is going to decline (39%) or stay the same (29%) in the next 6 months.

- Even with the serious financial problems facing the nation, one-half of consumers (52%) feel that their financial situation does not have a negative impact on their mental health. 39% feel it does, while 9% are unsure.

Worries About Savings: More Pronounced among Families with Children

Although economic pressures have eased to some extent, high inflation and interest rates continue to impact U.S. consumers. Our survey revealed that worries over the U.S. economy are sparking concerns over consumers’ savings, and this sentiment is more pronounced among families with children in the household.

Although economic pressures have eased to some extent, high inflation and interest rates continue to impact U.S. consumers. Our survey revealed that worries over the U.S. economy are sparking concerns over consumers’ savings, and this sentiment is more pronounced among families with children in the household.

- Just over one-half (56%) of consumers are worried about the safety of their savings, while just under one-half (46%) are worried about the value of their investments.

- While a large chunk of Americans are concerned about their savings and investments, the banking crisis hasn’t discouraged consumers from keeping their money in bank accounts. Only one-quarter have considered taking all of their money out of their checking or savings accounts.

- U.S. consumers with children in their household are more likely to be worried about the safety of their savings (66%) and their investments (60%). Moreover, they are more likely to say they have considered taking all of their money out of their checking or savings accounts (35%).

Interested in Designing Your Own Consumer Sentiment Study?

Consumer sentiment can change on a dime, which is why keeping up with your target consumers’ perceptions and priorities is key for building your strategy. We can help! Our team of market research experts can help you stay connected to trends in your category, maintain awareness of your target consumers, and understand how sentiment is shifting over time.