At year’s end, marketers and retailers often reflect on the past year to understand the best strategies to close out the year and leverage holiday shopping. However, a complete review of sales trends is also an effort to predict and forecast consumer behavior moving into the new year. There was a time when these efforts could be handled in-house, with a quick consideration of stock, sales, and other cultural trends. But, as we all know, that changed in 2020. With the arrival of Covid-19, consumer sentiment shifted as did consumer spending and shopping behaviors. Suddenly, demand forecasting wasn’t so easy.

When coupled with supply chain issues and variable customer moods, consumer behavior is harder than ever to predict. That doesn’t make it any less valuable. In fact, understanding consumer sentiment is, in many ways, the key to understanding consumer demand. It’s why we’ve released the next iteration of our COVID-19 Pandemic U.S. Tracker Study: State of Consumer Mindsets, Attitudes and Behaviors.

As a follow-up from our October 2020 study, this research provides invaluable key insights into the evolving consumer sentiment that drives consumer behavior. Preparing for 2022 means leveraging every tool available to you in what has been an unpredictable market space.

2021 is rapidly coming to a close with just the holiday shopping season between us and the new year. Typically, the holiday season is make or break time for retailers, restaurateurs, and manufacturers alike. Everyone relies on year-end consumer spending to move ledgers into the black. However, as we learned in 2020 and 2021, things evolve quickly.

Key Consumer Behavior Insights for 2022

As Covid vaccinations have risen, so has a return to something close to normal for many people. For that reason, some of the consumer trends we’re expecting suggest that consumer behavior, in some areas, will start returning to normal patterns, but obviously, there’s much to consider.

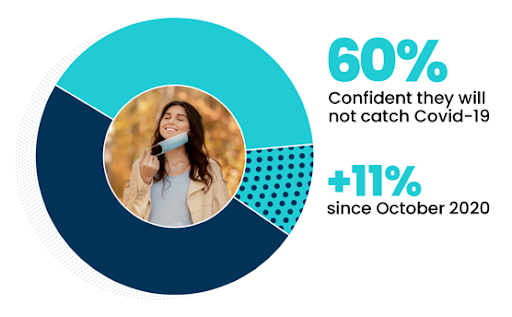

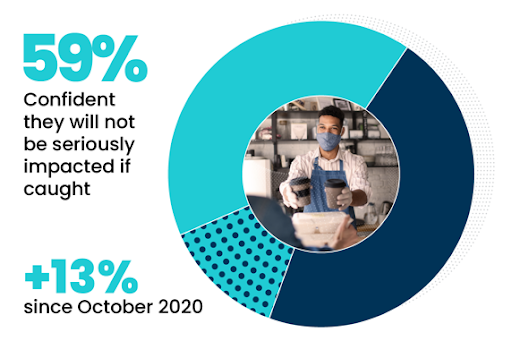

Outsized overall optimism: A year on from our last study in 2020, overall consumer optimism is up, it’s now at its highest since the pandemic began (March 2020). Consumer sentiment suggests people recognize the road to recovery with the nation’s; similarly, their own personal well-being is up overall. This can be attributed to the broad uptake in vaccines and growing interest in booster shots (77% of those vaccinated are comfortable with boosters).

Compared to a year ago, consumers are noticeably less worried about COVID-19.

Personal panic peters out: People are less concerned about catching COVID-19 due to high vaccination and declining infection rates, and there are indications of consumer optimism as we shift away from “COVID behaviors” and move into more predictable consumer behaviors.

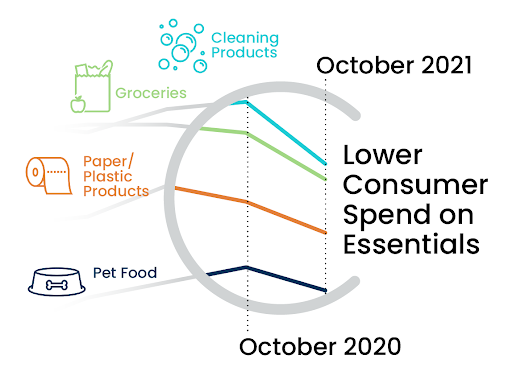

Financial fears transition as we approach holiday shopping periods: Consumers are cautious about spending more across many essential categories.

However, compared to a year ago, consumers are more likely to have a positive outlook heading into the holiday season. It’s up a full 8 points from October 2020 to 60% expressing optimism for the next 3 months.

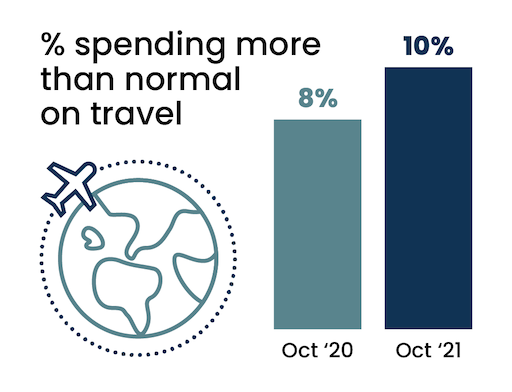

This consumer sentiment translates into feeling more comfortable in more places. In the past year, in-person dining, lodging & entertainment are seeing the largest shift to normal consumer behavior.

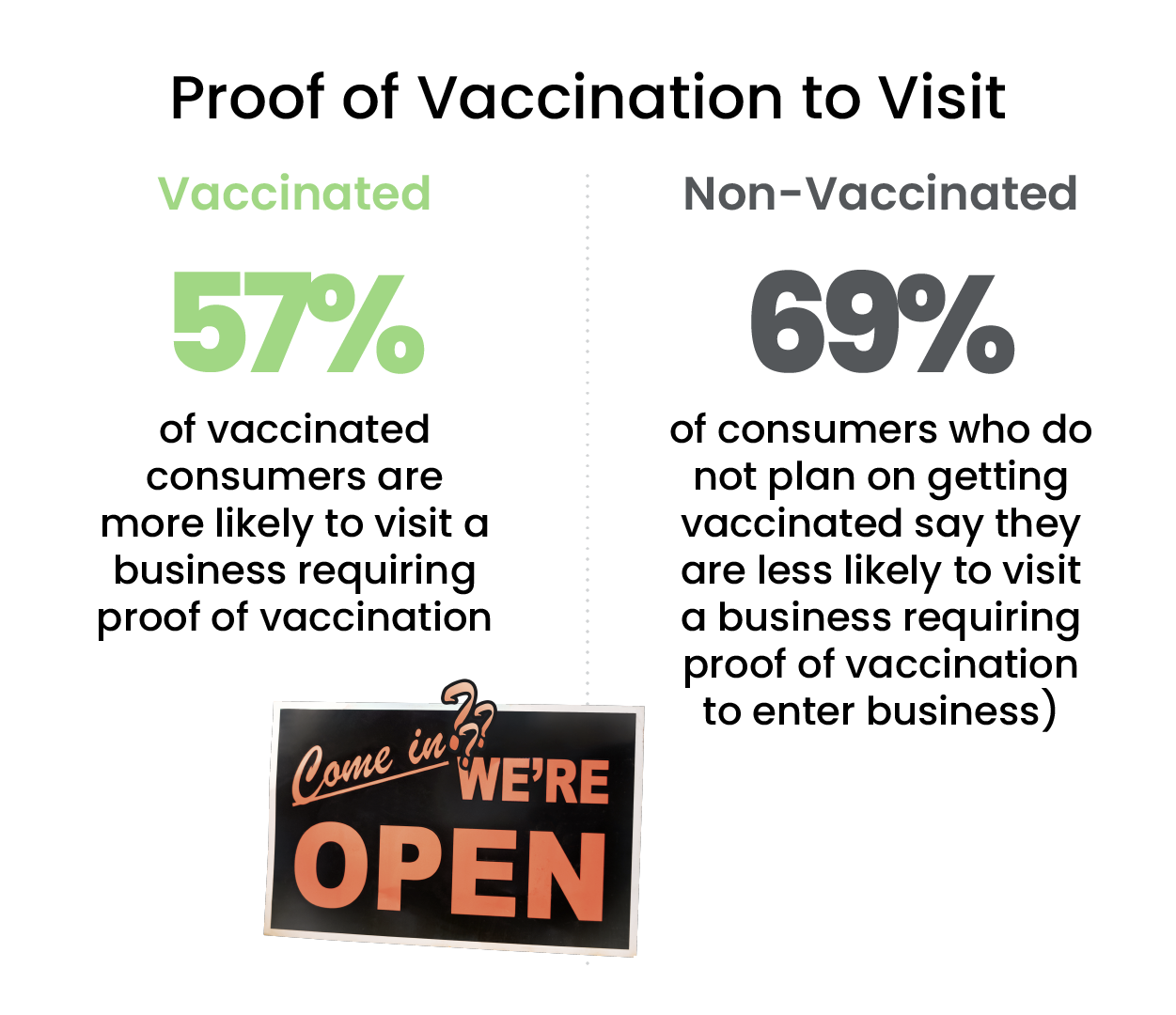

Serving the shotless: However, predicting consumer behavior regarding Covid-19 risk mitigation is a bit harder. In response, many retailers and restaurants are considering vaccine requirements. They will need to balance the opportunity of giving vaccinated customers the added security they want versus accommodating those without the jab who, given current data, are less likely to get vaccinated.

Over the past few years, retailers who have been able to remain agile and responsive to consumer behavior and consumer sentiment have been able to ride out this volatile period. We’re not quite back to normal yet, but demand forecasting is no less important. Understanding consumer demands could be the key for a successful 2022.

Is your brand ready for a post-COVID marketplace? Do you have a strategy in place to meet new consumer demands? To adapt to new consumer behaviors?

Our report will help you learn what to expect and, more importantly, how to prepare. Meet with our research team today to review the full report findings.