As the COVID vaccine rollout accelerates and consumer market conditions continue to evolve, businesses are facing a number of new questions:

• Are consumers finally ready to ease back into their pre-pandemic routines and behaviors?

• What opportunities—and challenges—do recent shifts in consumer attitudes present?

• How can you build more informed marketing and media plans for the coming year?

We looked at these questions in the March wave of our 2021 Consumer Sentiment Tracking Study, and we found some optimistic news about consumer attitudes toward health and wellness, financial security, and their personal lives.

Consumers are now exhibiting behaviors and attitudes that indicate a gradual return to their pre-pandemic lives.

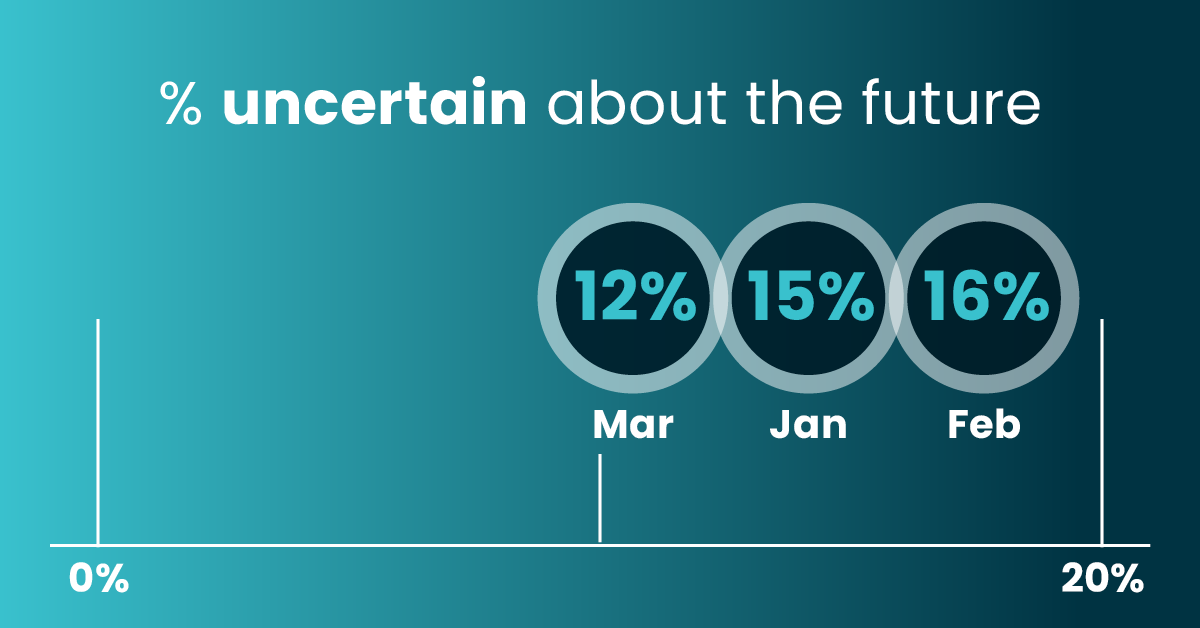

Consumers appear to be less uncertain about the future now, with 12% now saying that “the uncertainty feels like it’s never going to end,” down from 15% in January, and 16% in February.

We also saw a decrease in concern about when the pandemic will end. In March, 34% said that not knowing when the pandemic will end is their top concern, down from 44% in January. It seems consumers are beginning to see light at the end of the tunnel.

Consumers remain generally optimistic about their personal health. That may be related to some other interesting findings: Consumers appear to be curtailing the hygiene habits they developed over the past year, and some say they are less apprehensive about venturing out for dining and entertainment.

Specifically, the number who say they are carrying hand sanitizer has fallen from 43% in January to 38% in March.

Just 32% now say “spending time at home” is more important than ever, down from 46% in January. This accompanies a decrease in those who said dining out was less important—52% agreed in January, but only 44% in March.

This may reflect a shift toward a post-COVID mindset, which could be a signal for entertainment and hospitality businesses to plan to welcome more customers back. Retailers who struggled to keep hygiene and sanitation products in stock in recent months may now want to reconsider their future ordering and inventory plans.

Overall, health and wellness is certain to remain a top concern for many well into the future, representing an opportunity for new products like immunity-boosting foods and beverages, which are among the top 3 categories that Americans are turning to for innovative new products.

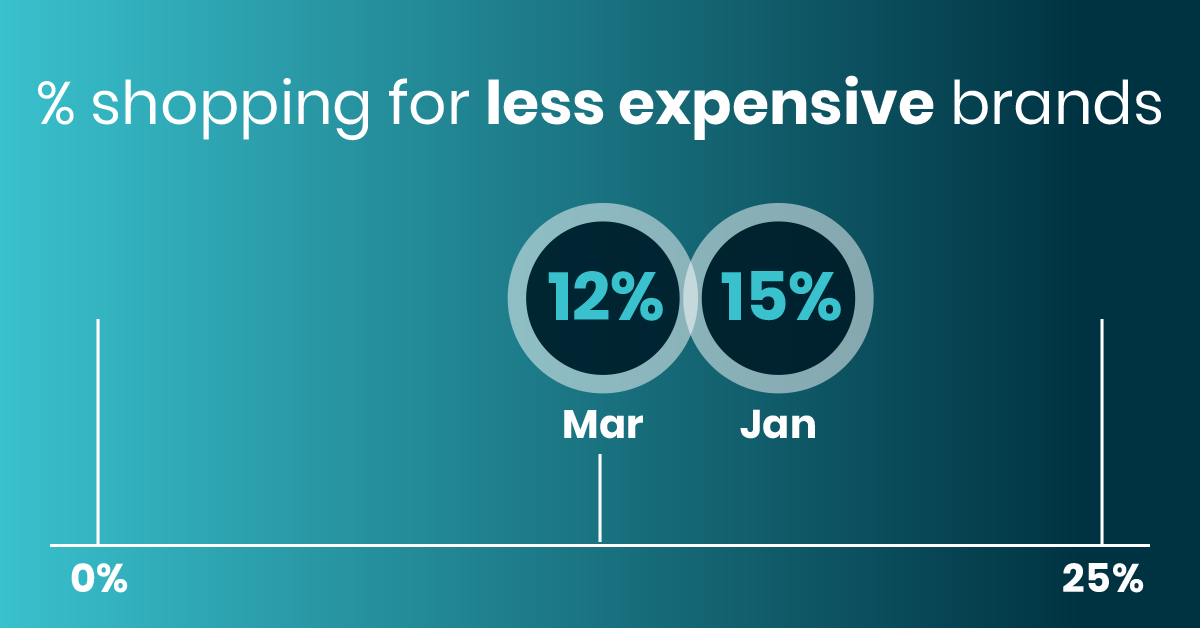

Consumer optimism can also be seen in their attitudes toward their finances. They remain confident in their ability to pay for basic necessities, and they are less pessimistic about their ability to splurge on special purchases. They also appear to be less concerned about stretching their dollars, with 12% now saying they are shopping for less expensive brands, compared to 15% who were bargain hunting in January.

The arrival of stimulus checks and other financial assistance may drive an overall increase in consumer spending. Consumer willingness to splurge might represent a particular opportunity for upscale or luxury brands.

Personal and mental well-being continue to be key concerns as consumers gear up for a return to their normal lives.

Concerns about anxiety and stress are beginning to recede, with 41% now saying they’re optimistic about their ability to manage their stress level compared to 37% in February. 56% say focusing on their mental health is now more important than ever. These developments open the door for new products and services that address issues like stress reduction, personal growth, and mindfulness.

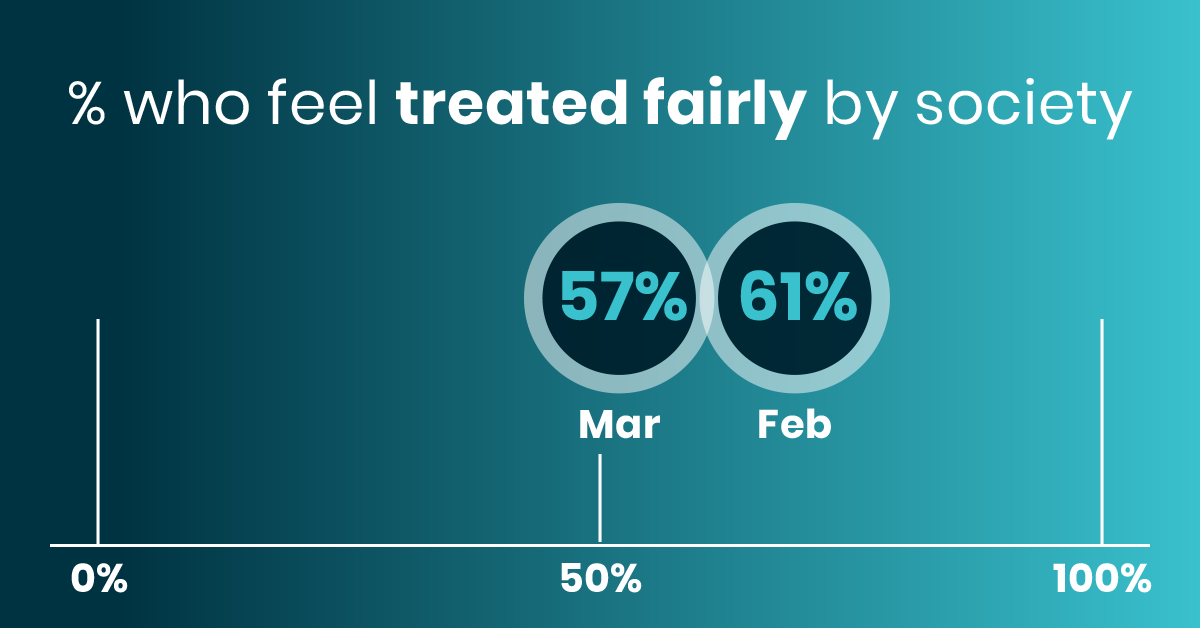

One overlooked concern among some consumers is the need to feel they are being treated fairly by society. We found growing pessimism in consumer expectations about fair treatment, with just 57% saying they felt confident about being treated fairly in March, down from 61% in February. A messaging strategy that addresses fairness could be a way to connect with disaffected consumers whom other brands are not addressing.

Over the past three months, our 2021 Consumer Sentiment Tracking Study has revealed a number of surprising shifts in consumer attitudes. How your business adapts and responds to these changes will have a direct impact on your performance this year.

To position your business for success, you need timely, accurate data on current trends, and informed insights about what the months ahead may bring.

That’s exactly what our research team delivers.

Schedule a consultation to learn how you can add up to five or more custom questions to our ongoing tracking survey. Each month, you’ll receive a custom report including our full survey results with your questions integrated, giving you a real-time readout of changes in consumer sentiment as they happen.