THIS SURVEY EXPLORES CANADIANS’ AND AMERICANS’ PERSPECTIVES ON MORTGAGE RATES AND INFLATION.

As inflation remains high, many Canadians and Americans are exploring ways to reduce their expenses. In our latest North American Tracker, we explored how inflation is impacting Canadians and Americans, and how an increase in mortgage rates would impact Canadians and Americans who currently have a mortgage.

This survey is conducted in collaboration with the Association for Canadian Studies (ACS) and published in the Canadian Press. This series of surveys is available on Leger’s website. Would you like to be the first to receive these results? Subscribe to our newsletter now.

MORTGAGE RATES AND INFLATION

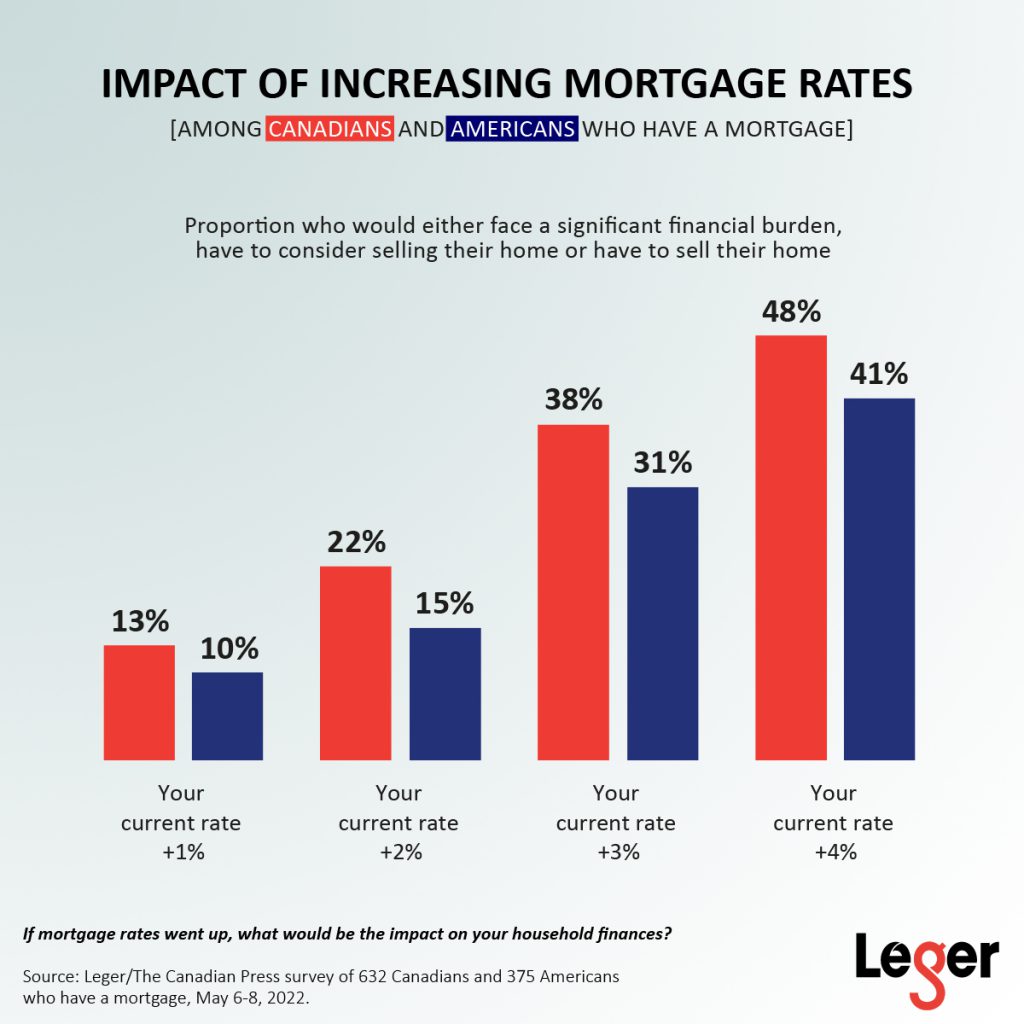

- If mortgage rates went up by 1%, 13% of Canadians and 10% of Americans who have a mortgage would either face a significant financial burden, have to consider selling their home or have to sell their home. These figures balloon if rates were to increase by 3%.

- The proportion of Canadians (85%) and Americans (88%) who indicate that inflation is a serious problem for their household has increased since our last survey published on March 17, 2022.

- The top actions Canadians and Americans have taken due to rising inflation over the past few months are:

- Buying less expensive items at the grocery store (65% of Canadians, 49% of Americans)

- Eating at restaurants or ordering take-out less often (53% of Canadians, 41% of Americans)

- Reducing food waste to make their money go further (46% of Canadians, 40% of Americans)

SURVEY METHODOLOGY

This web survey was conducted from May 6 to 8, 2022, with 1,534 Canadians and 1,003 Americans, 18 years of age or older, randomly recruited from LEO’s online panel.

A margin of error cannot be associated with a non-probability sample in a panel survey. For comparison, a probability sample of 1,534 respondents would have a margin of error of ±2.5%, 19 times out of 20, while a probability sample of 1,003 respondents would have a margin of error of ±3.094%, 19 times out of 20.

THIS REPORT CONTAINS THE RESULTS FOR THE FOLLOWING QUESTIONS AND MORE!

- If mortgage rates went up, what would be the impact on your household finances?

- How serious a problem is inflation/increasing interest rates for your household?

- How would you describe your own household’s finances today?

- What is the impact of inflation on your household in the following areas? Has inflation had…