The first Canadian study to reveal how to maintain and create momentum for your brand.

The COVID-19 pandemic has fundamentally changed how consumers interact with brands, both in-store and online. With this in mind, Leger is launching a first of its kind study focused on building and maintaining brand momentum.

The Brand Momentum Study, created by Leger, answers the following questions:

- Does your brand currently have what it takes to stay and grow in its category?

- How do perceptions vary among your buyers (retention) and your non-buyers (acquisition), and what actions should be taken?

- What are the strengths and weaknesses of other brands in your category?

- Which brands will emerge, grow, mature, and be at risk in your category in the next three months?

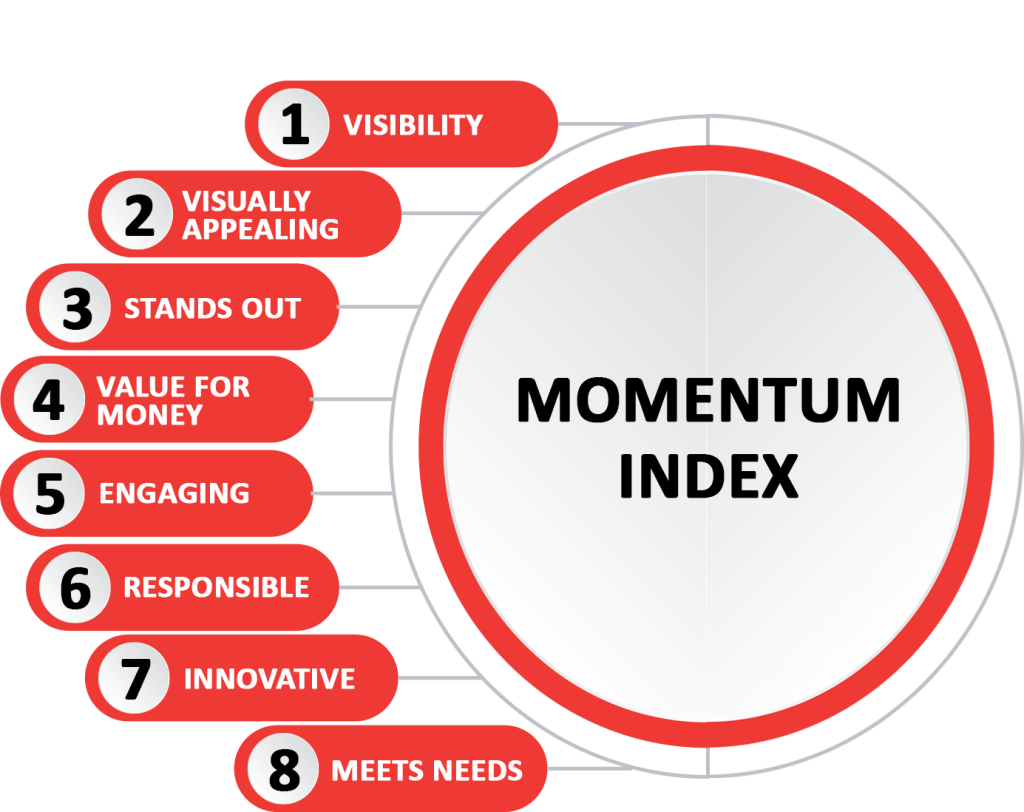

THE MOMENTUM MODEL

The existing models measure present or past brand perceptions. They mainly measure intangible aspects of the brand (emotion, commitment, etc.) or financial value (sales).

This study measures perceptions of more tangible attributes of your brand and identifies which attributes to work on to increase short-term purchasing intentions.

KEY FINDINGS OF THE STUDY

IN THE CONTEXT OF A PANDEMIC, CLEANLINESS IS MORE POPULAR THAN EVER.

The household laundry and cleaning product category has never been so popular! Several brands in particular (like Tide, Lysol, Mr. Clean, and Swiffer) are on the rise in Canada, and In Ontario, brands like Vileda and Scoth-Brite are also building momentum. But which brands will remain anchored in our post-pandemic daily lives? Stay tuned to find out.

HEALTHY EATING AND GOOD HEALTH ARE KEY CONCERNS.

Two vegetarian and vegan brands, Gardein and Sunrise, are growing in Canada, and several brands with a more limited reach, like Cedar Lake, Gusta, and Bonduelle, are all set to grow over the next three months. Canadians want to eat healthy food, but they also want to choose quality products – even if they end up choosing shortcuts like “gourmet” products and prepared meals. After all, restaurant outings have become less frequent, so why not create a “restaurant effect” at home?

INNOVATIVE PRIVATE LABEL BRANDS ARE INCREASINGLY LOVED BY CANADIANS.

President’s Choice and Kirkland have gained momentum across Canada, and mainly because consumers tend to see them as more innovative and differentiated than the competition. In Ontario, Blue Menu is also on the rise. Since the beginning of the pandemic, Canadians have certainly become more frugal, but they’ve also shown loyalty to their local food market, now that grocery shopping at two or more stores is no longer very pleasant during a pandemic!

THE HEALTH TREND IS A TURNING POINT IN THE JUICE AND BEVERAGE CATEGORY.

Five of Canada’s top ten at-risk brands are in the beverage category: Kool-Aid, Fairlee, Sunlike, Fruité and Everfresh. When it comes to actual juice, though, Oasis is the number one growing brand in Quebec (evidence that the health and smoothies tangent can pay off!) One thing is certain, however: there is room for innovation in this sector.

DELIVERABLES

- Ranking of brands according to the Momentum Index

- Brand positioning based on attributes (total and buyers vs non-buyers of the brand)

- Importance of attributes in anticipated purchasing

- Brand growth map

- Perceptual map of brands

METHODOLOGY

- Survey of approximately 12,000 Canadians aged 18+ who are responsible for buying groceries

- 200 brands are evaluated across 18 categories (300 respondents who are buyers in the category and know the brand evaluate each brand): bread, snack bars, coffee, cookies, frozen desserts, juice, milk, yogurt, laundry products, household products, cleaning products, paper products, private brands, ready-to-eat meals, canned meals, frozen vegetables, vegetarian/vegan, meat

- Data collection will be conducted in September, with results released in October 2020

DOES THIS STUDY INTEREST YOU? FILL IN THE FORM BELOW TO CONTACT US.

[mc4wp_form id=”27724″]