THIS SURVEY EXPLORES CANADIANS’ AND AMERICANS’ PERSPECTIVES ON INTEREST RATES, INFLATION AND THEIR ECONOMIC CONCERNS.

In Canada, the inflation rate has reached a new 30-year high, while in the United States, Americans are seeing a new 40-year high.

To combat rising inflation, the Bank of Canada has raised interest rates, and the Federal Reserve is expected to do the same shortly.

Our latest North American tracker set out to explore how the economic situation is impacting households, and how Canadians and Americans are behaving in response to the rising rates.

This survey is conducted in collaboration with the Association for Canadian Studies (ACS) and published in the Canadian Press. This series of surveys is available on Leger’s website.

Would you like to be the first to receive these results? Subscribe to our newsletter now.

Inflation, Interest Rates and Economic Concerns

- 81% of Canadians and 85% of Americans say that inflation is a very or somewhat serious problem for their household. The rising cost of groceries and gasoline is being felt most acutely.

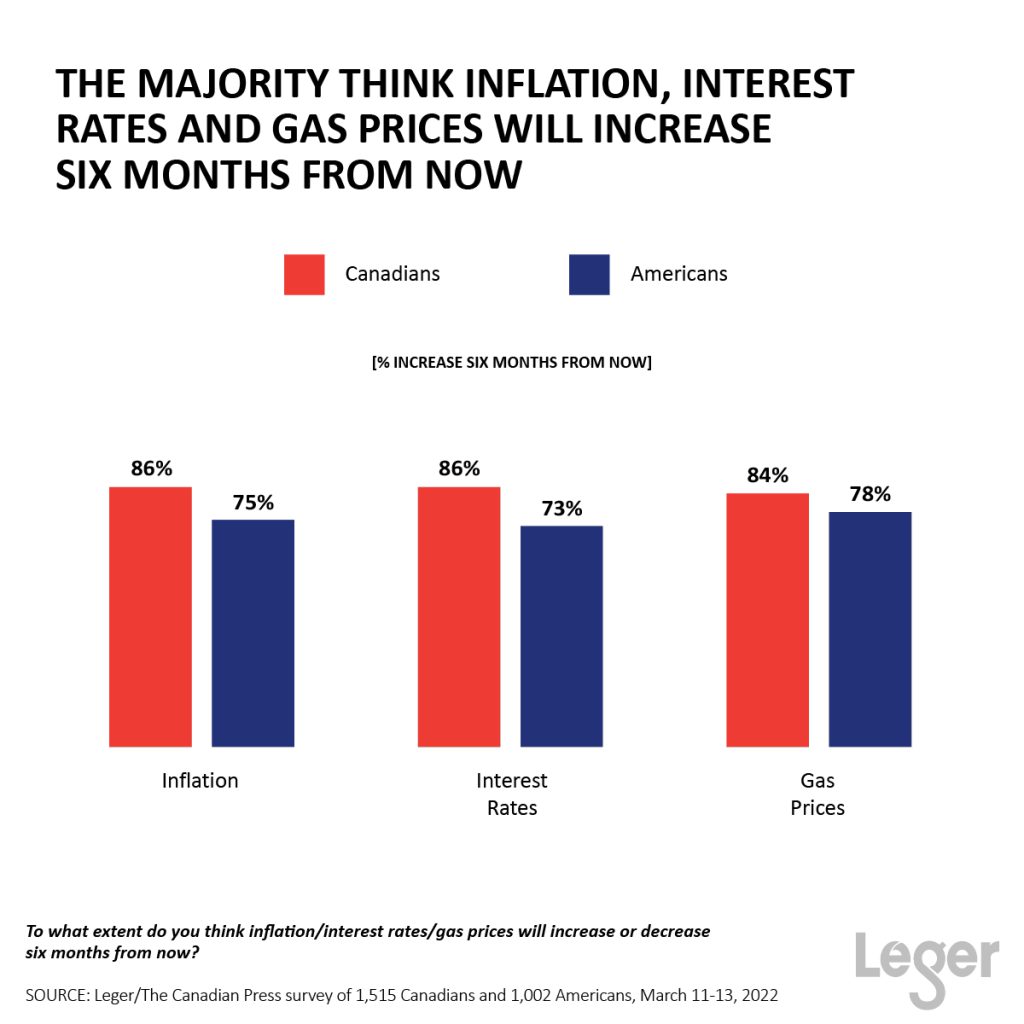

- Canadians and Americans have a pessimistic outlook for the future: the majority think inflation, interest rates and gas prices will increase six months from now.

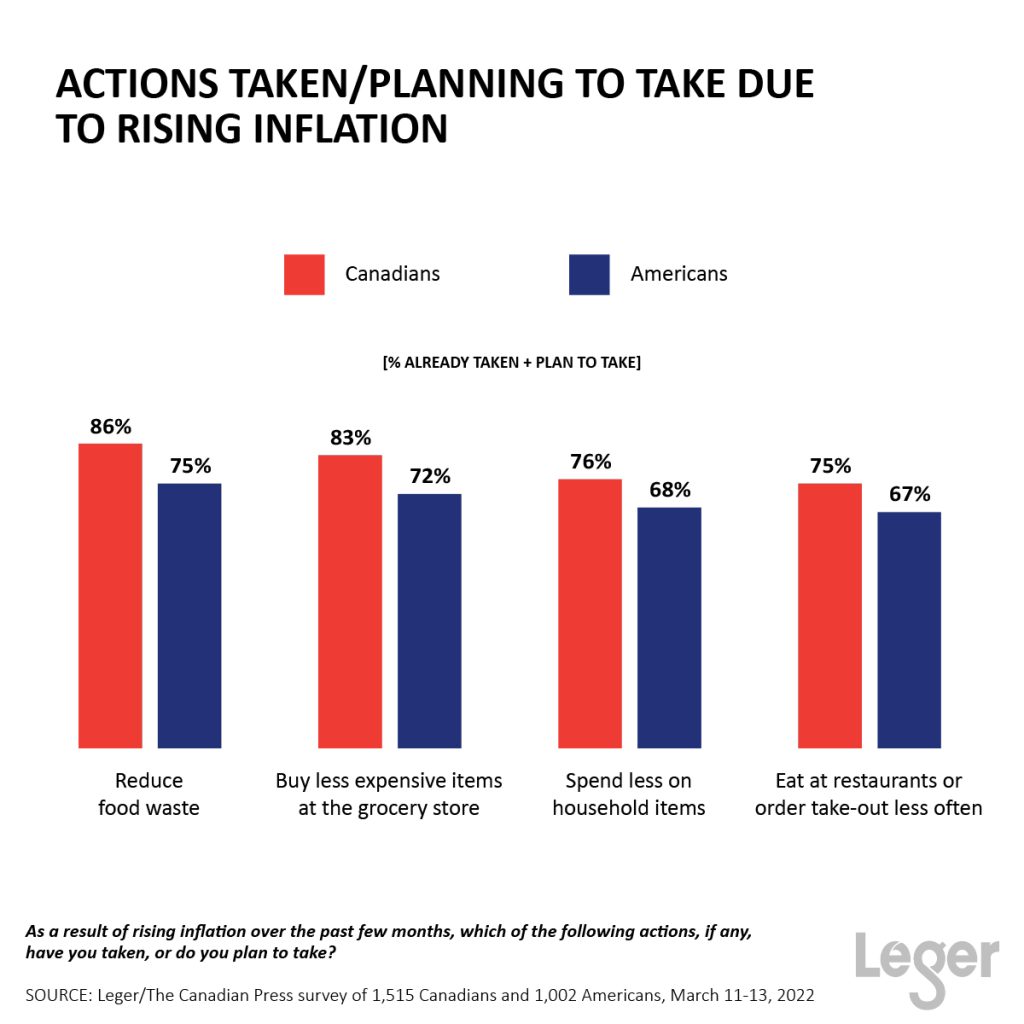

- The top actions Canadians and Americans have taken or plan to take due to rising inflation are

- Reducing food waste to make their money go further (86% of Canadians, 75% of Americans).

- Buying less expensive items at the grocery store (83% of Canadians, 72% of Americans)

- Spending less on household items (76% of Canadians, 68% of Americans).

- Eating less often at restaurants or limiting take-out (75% of Canadians, 67% of Americans), which doesn’t bode well for a sector still trying to recover post-pandemic.

METHODOLOGY

This web survey was conducted from March 11 to March 13, 2022, with 1,515 Canadians and 1,002 Americans, 18 years of age or older, randomly recruited from LEO’s online panel.

A margin of error cannot be associated with a non-probability sample in a panel survey. For comparison, a probability sample of 1,515 respondents would have a margin of error of ±2.5%, 19 times out of 20, while a probability sample of 1,014 would have a margin of error of ±3.096%, 19 times out of 20.

THIS REPORT CONTAINS THE RESULTS FOR THE FOLLOWING QUESTIONS AND MORE!

- How serious a problem is inflation/increasing interest rates for your household?

- How would you describe your own household’s finances today?

- What is the impact of inflation on your household in the following areas?

- To what extent do you think inflation / interest rates / gas prices will increase or decrease six months from now?